Staying up to date with current business tax and energy relief schemes can make it easier to help your customers get to ‘yes’ on your commercial solar proposals.

Here’s what you need to know about changes to some of the schemes from 1 April 2023.

What’s ending?

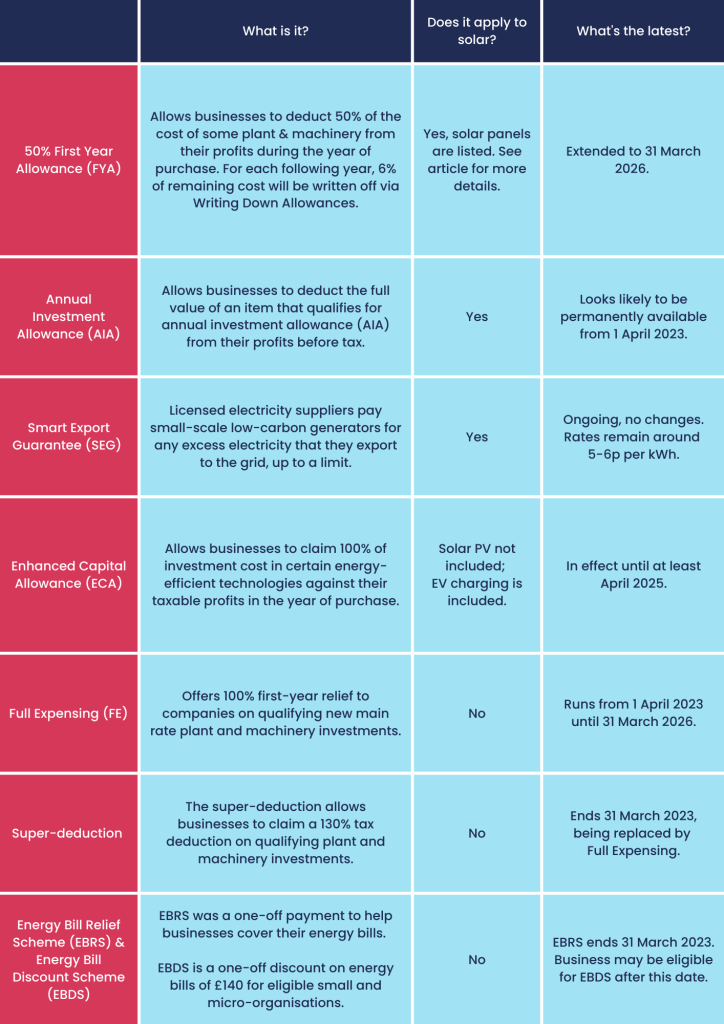

The Super-deduction incentive ended on 31 March 2023. It has been replaced by the new Full Expensing (FE) allowance announced on 15 March 2023 – see below for details.

The Energy Bill Relief Scheme (EBRS) for businesses has also ended This was another short-term measure that gave SMEs a one-off payment to help cover their energy bills. It was replaced by the Energy Bill Discount Scheme (EBDS), detailed below.

What’s new?

From 1 April 2023 until the end of March 2026, companies can claim 100% capital allowances on qualifying plant and machinery investments under the new Full Expenses (FE) scheme. This scheme allows businesses to deduct 100% of the cost of certain plant and machinery from their profits straight away, rather than more slowly over the life of the asset.

From 1 April 2023, the Energy Bill Discount Scheme (EBDS) will provide a discount off gas and electricity bills of up to £140 for eligible small and micro-businesses.

Eligible non-domestic consumers can now receive a reduction of their energy bills up to a maximum discount. The relative discount will be applied if wholesale prices are above a certain price threshold – usually £19.61 per megawatt hour (MWh) with a price threshold of £302 per MWh for electricity and £6.97 per MWh with a price threshold of £107 per MWh for gas.

What’s sticking around?

The Enhanced Capital Allowance (ECA) scheme, which is in effect until at least April 2025, allows businesses to claim 100% of the cost of qualifying energy-efficient technologies in the year of purchase. Because solar PV is classed as a long-life asset and not ‘main rate equipment’ it’s not included in this allowance, but the following are included:

- electric cars

- electric vehicle charging points

- plant and machinery for gas refuelling stations

- gas, biogas and hydrogen refuelling equipment

- zero-emission goods vehicles

The Annual Investment Allowance (AIA) is a tax break that businesses in the UK can claim for investing in equipment and machinery. The AIA has been extended indefinitely as of April 2023. Read more here.

Businesses can reduce their tax bill by claiming tax relief on the full cost of qualifying assets (up to a certain limit, which is currently set at £1 million per year). Businesses that buy qualifying solar or other energy-efficiency equipment via a Smart Ease Hire Purchase agreement may be able to claim AIA, ECA and/or FE provided that all VAT is paid upfront. Speak to your accountant to seek independent advice for your business.

The Smart Export Guarantee (SEG), in which businesses are paid for every unit of excess electricity that they feed back into the grid, is also ongoing. Find eligibility criteria here.

What does this mean for you?

With the end of the EBRS and power prices still climbing, businesses will be re-evaluating their energy usage and thinking about how they can reduce their power bills. Key points:

- To reduce costs, commercial solar is the logical solution for organisations with suitable rooftop space.

- Alert your customers to the available incentives that they can discuss with their tax advisor or accountant.

- Given current economic conditions, businesses will prioritise protecting cash flow. Access to fast, fuss-free funding options will be more important than ever when it comes to closing commercial solar deals.

EXTRA RESOURCES

Read more about these schemes and allowances in detail:

Annual Investment Allowance (AIA) 1

Annual Investment Allowance (AIA) 2

For more insights into how you can help your customers explore tax and energy benefits, get in touch with our Sales Director.